PATNA/NEW DELHI: It’s official.

British Virgin Islands (BVI), a known tax haven where businessmen and politicians have in the past stashed stacks of money, has put the first stamp on India’s probe into black money.

This may help cops and officials get back crores of rupees.

A decade after RK Verma, former power secretary in Delhi’s Sheila Dikshit government, stirred a controversy on deposit of funds into an overseas bank account ,allegedly operated by his wife, the investigators may now be close to nailing the accused.

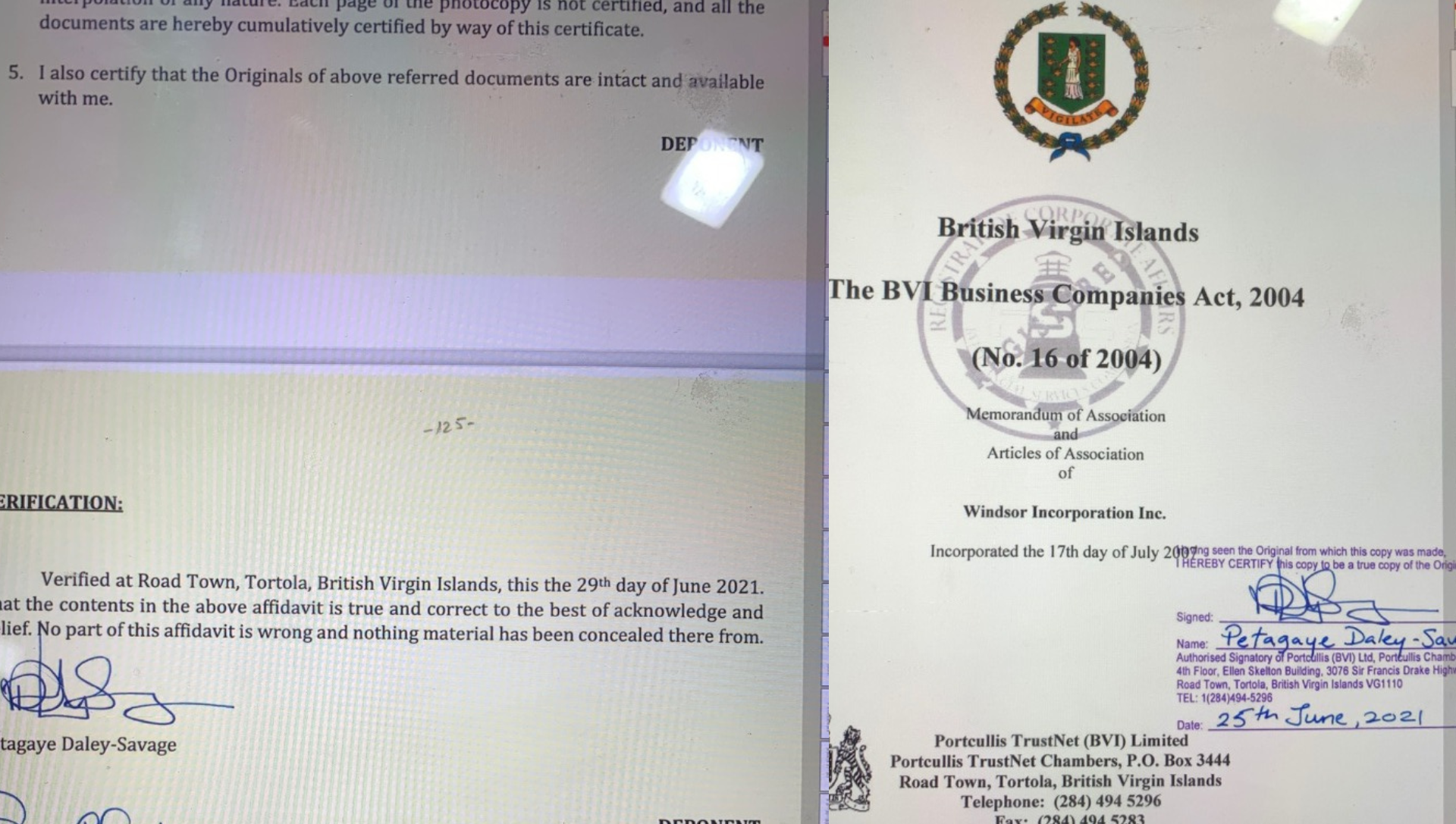

An investigation by The New Indian team reveals the stamped papers from BVI arrived in India on June 29, 2021.

The latest set of replies from UK government received by the Indian authorities include a verified document — stamped in red-ink — on the ownership of Windsor Incorporation.

They also include a certificate that has been signed. Petagye Daley Savage, the registered agent for the Windsor Incorporation. The document is attested by the notary public Denise Charles from Road Town Tortola.

The ownership includes Verma’s passport copy and her signatures. Which is why I-T is now upbeat on prosecution against Verma and finding the money’s original owners — whether a politician or businessman or a corporate group.

Asked if this key document from UK would strengthen India’s case to bring back black money or strengthen court’s scrutiny into such offshore accounts

“Yes, it surely does and it is not only this case but there are hundred of cases where the tax authorities have been working upon and trying to get information and which is also coming forward to India,” said Arpit Batra, lawyer of Income Tax prosecution in special courts.

I-T on Verma’s money trail found alleged deposits running into Rs 100-crore – a colossal amount by any yardstick for any bureaucrat to possess — into the bank account operated by UBS AG Singapore and account number 140184.

The fresh document, dated June 29, 2021, is clearly marked as “verification”at the top, leaving little doubt on the authenticity on formation of the company.

Savage, in his reply has told the Indian tax authorities,:“In virtue of the letter/summons dated June 21, 2021 issued by the International Tax Authority for supply of documents or copies of original records of documents detailed, intended to be used as evidence or official purpose by Income Tax authorities in the requesting jurisdiction thus calling upon the registered agent to produce the enlisted information and documents as set out in the letter.”

A team of The New Indian visited the earlier residence of Verma in Delhi’s Chanakyapuri and RK Puram areas and even travelled to Bihar’s Patna and Gopalganj, but the family remained “unavailable”.

“Look, I have nothing to take with the story. Those who want to write will write. How can I stop them? Those who have the idea of news will write it. What he wants to do he will do, and what I have to do I will do,” Verma told The New Indian reporters.

He also said that he and his family will “corner” the I-T in the court. “And whatever I will have to do I will do it in court. Why should I oppose it outside court?,” he added.

I-T alleges Verma is the authorized representative of the company in the account opening form.

Her copy of passport is attached as verifying identify of beneficial owner apart from her signature, a charge she has repeatedly denied in the court.

Windsor Incorporation Inc was incorporated on July 17, 2007 in BVI, when Verma was still serving as an IAS in the Dikshit government.

Till earlier this year, the I-T department was struggling with photocopies of the formation of company, which had been categorically denied by Ritu Verma and her lawyers in the court.

“What I can say that documents are being filed in the court only when they are legally admissible,” Batra maintained.

The Income Tax department had sought a reply from the British Virgin Islands in January this year.

“Currently, there is nothing on record to establish a strict relationship between the registered agent, namely Portcullis TrustNet Limited – that had incorporated Windsor in BVI and Ritu Verma. Thus, firstly, in order to complete and establish the chain of events which points at the guilt of the accused, it is incumbent to establish t is important to establish the same beyond a reasonable doubt as the said fact forms the basis of the entire charge i.e. Ritu Verma is the director and shareholder of the Windsor Incorporation Inc and is the authorised signatory of its account opened in the bank of UBS AG Singapore, and that she did not made a disclosure in her returns filed in India of both the said facts.

According to charges, Verma held 50,000 shares valued at $1 per share since August 13, 2007 in Windsor Incorporation Inc. The shares had mentioned her Delhi’s Chanakyapuri address.

The New Indian question: If Ritu Verma says she is not the owner of the company, it’s still a mystery how so much of wealth was stashed in US dollars and Swiss Francs in UBS Singapore bank account. Who was the original source of the money and who was the money intended to reach? And what is the money doing in the bank account now?