New Delhi: India’s Finance Minister Nirmala Sitharaman on Sunday unveiled a sweeping budget for 2026-27, pledging to accelerate economic growth through massive investments in manufacturing, infrastructure, and job creation, while maintaining fiscal discipline in a volatile global environment.

In her ninth consecutive budget speech – a record for any Indian finance minister – Sitharaman highlighted the government’s achievements over the past 12 years under Prime Minister Narendra Modi, crediting “focused decisions” for stable growth and low inflation. She emphasised a shift from “ambiguity to action” and “populism to people,” with over 350 reforms rolled out since Modi’s 2025 Independence Day announcement, including GST simplification and labour codes.

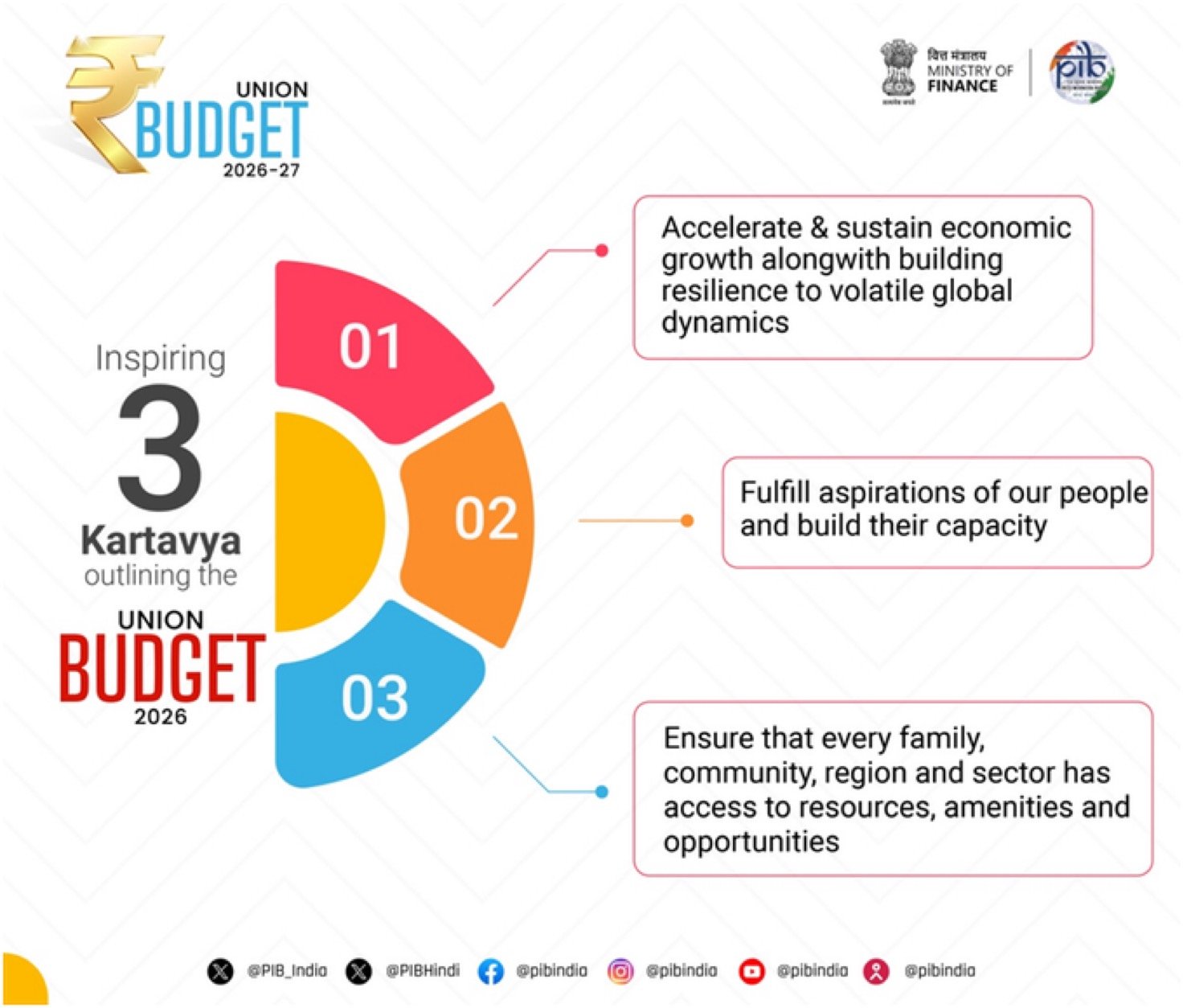

The budget is structured around three core “kartavyas” or duties: sustaining growth, fulfilling aspirations, and ensuring equitable access. Central to the plan is a record public capital expenditure of 12.2 lakh crore rupees ($146bn), up from last year, aimed at infrastructure in tier-2 and tier-3 cities. This pushes “effective capex” to 4.4% of GDP, the highest in a decade, with an additional 1.85 lakh crore rupees allocated to states for reforms.

Under the first kartavya, the government targets scaling up manufacturing in seven strategic sectors. Key initiatives include the Biopharma SHAKTI scheme with 10,000 crore rupees over five years to position India as a global biologics hub, and ISM 2.0 for semiconductors, with 40,000 crore rupees for electronics manufacturing. Rare earth corridors in mineral-rich states like Odisha and Kerala aim to cut import dependency, while new schemes support chemical parks, capital goods, container manufacturing, and textiles. A 20,000 crore rupees investment in carbon capture technologies targets industries like steel and cement for energy security.

To rejuvenate legacy sectors, 200 industrial clusters will be revived, and MSMEs get a boost via a 10,000 crore rupees SME Growth Fund and “Corporate Mitras” for compliance support. Infrastructure gets a “powerful push” with new freight corridors, 20 national waterways, and seven high-speed rail corridors linking cities like Mumbai-Pune and Delhi-Varanasi. City economic regions will receive 5,000 crore rupees each over five years.

The second commitment focuses on building human capacity. A high-powered committee will enhance education-to-employment links, particularly in services. Health initiatives include training 100,000 allied professionals and establishing regional medical hubs. In education, five “university townships” near industrial corridors and girls’ hostels in every district are planned. Sports see the launch of Khelo India Mission for talent development, while tourism gets upgrades to 15 archaeological sites like Lothal and a national hospitality institute.

The third agenda emphasises inclusion. For farmers, measures include fisheries development in 500 reservoirs, coconut and cashew promotion schemes, and Bharat-VISTAAR, an AI tool for customised agricultural advice. Empowerment for the disabled (Divyangjan) involves skill programs in IT and hospitality, plus access to assistive devices. Mental health gets a new institute in north India, and the north-east region benefits from an east coast industrial corridor, tourism sites, and 4,000 e-buses.

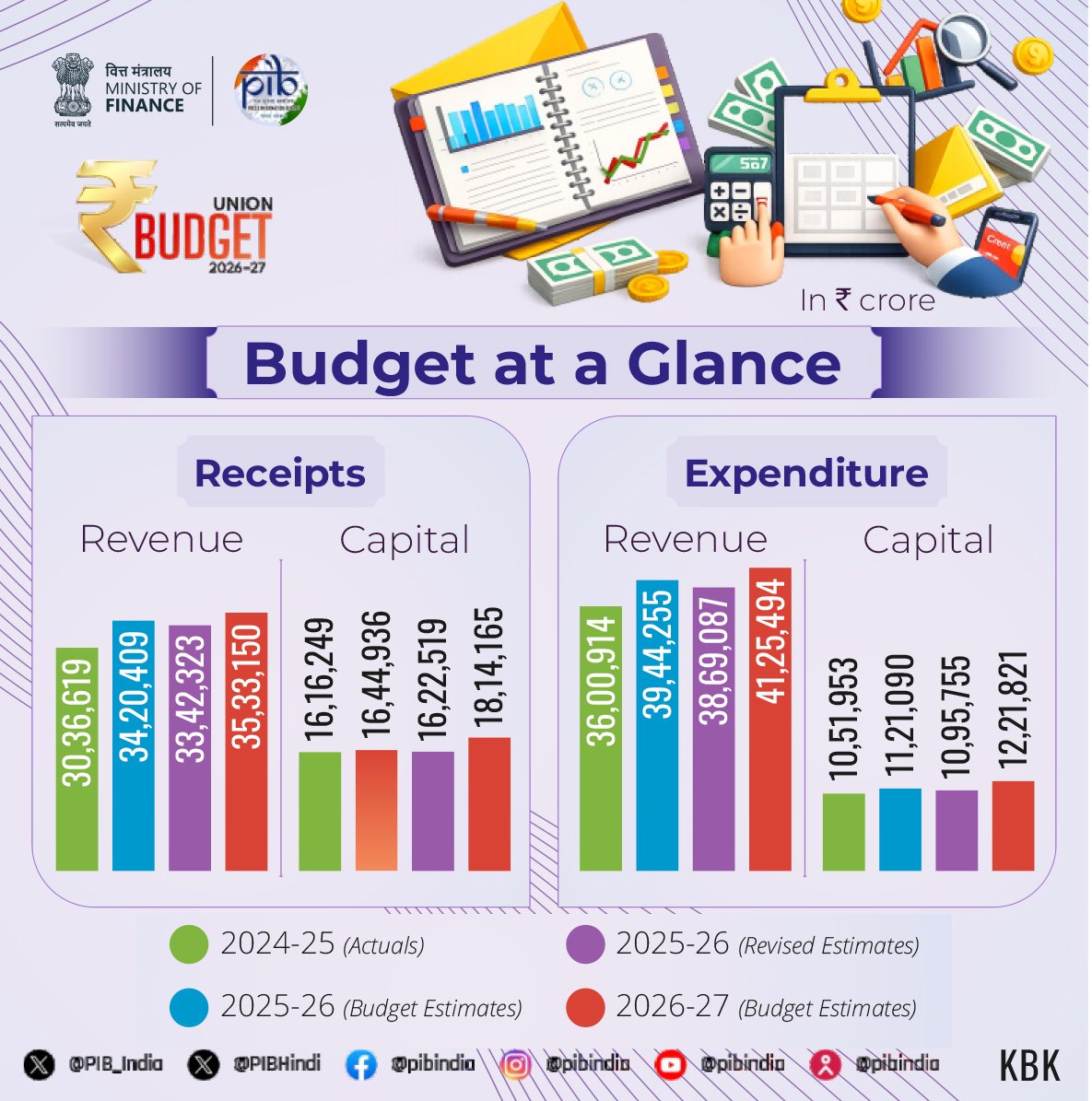

On the fiscal front, the deficit is pegged at 4.3% for 2026-27, down from 4.4% this year, aligning with a glide path below 4.5% by 2025-26. Tax reforms in Part B aim for ease: indirect taxes simplify customs with AI scanning and duty deferrals; exports of marine products get incentives. Direct taxes reduce TCS rates for tours and education, exempt accident claim interest, and rationalise penalties, with a one-time foreign asset disclosure scheme.

Financial sector reforms include a banking review committee and eased foreign investment rules, allowing non-residents to invest up to 10% in listed firms. Sitharaman drew inspiration from youth dialogues, calling it a “Yuva Shakti-driven Budget” to realise “Viksit Bharat.”

(Word count: 612)