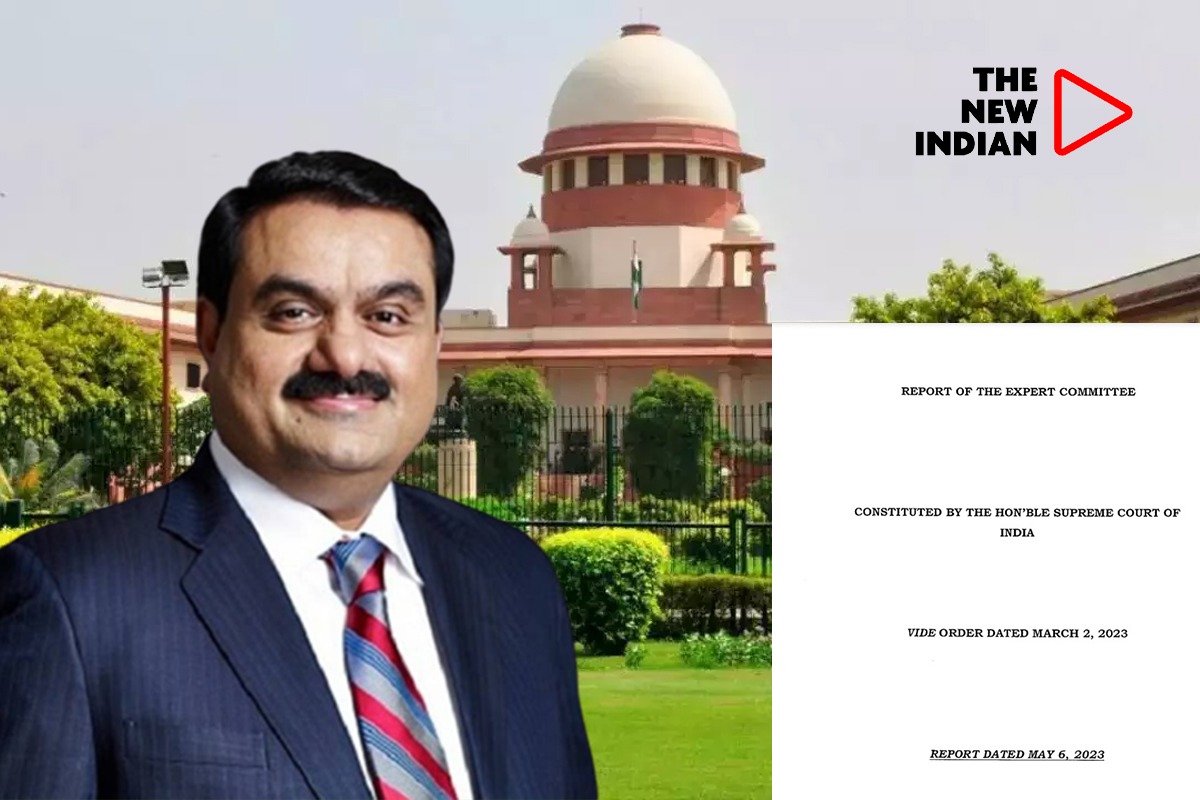

The Supreme Court on Friday released the report of the expert panel appointed to investigate the Hindenburg-Adani case. The report, dated May 6, thoroughly examines the potential impact of the dispute on market volatility and investigates investor awareness and regulatory lapses highlighted in the Hindenburg report. Key findings from the report include the disclosure of beneficial owners by the 13 overseas entities linked to Adani. The report further states that there is no apparent pattern suggesting manipulative involvement in the rise of Adani Energy’s stock price. The panel advises SEBI to analyze data from all Adani stocks using similar charts for further examination.

The panel, led by retired judge Justice AM Sapre, has conducted a preliminary assessment and concluded that the Securities and Exchange Board of India (SEBI) did not demonstrate negligence in their probe of the Adani Group. SEBI has been investigating 13 overseas entities linked to Adani since October 2020, described as “opaque” in nature. The report says that the 13 overseas entities having suspected links to Adani group promoters have given details of beneficial owners.

The expert panel’s interim report notes that SEBI has not been able to establish a solid case for prosecuting alleged violations based on their suspicions. The report also acknowledges that SEBI’s explanations, supported by empirical data, do not indicate any regulatory failure regarding the accusations of stock price manipulation.

Currently, there is no substantiated case regarding related party transactions or violations of Securities Regulations.

The Hindenburg report, published on January 24, significantly impacted the share value of various Adani companies, resulting in an estimated loss of around $100 billion. In response, the Supreme Court appointed a six-member expert committee to investigate the matter.

SEBI continues its independent investigation in coordination with the committee.

Read key excerpts from the report here:

On Volatility:

On investor awareness: