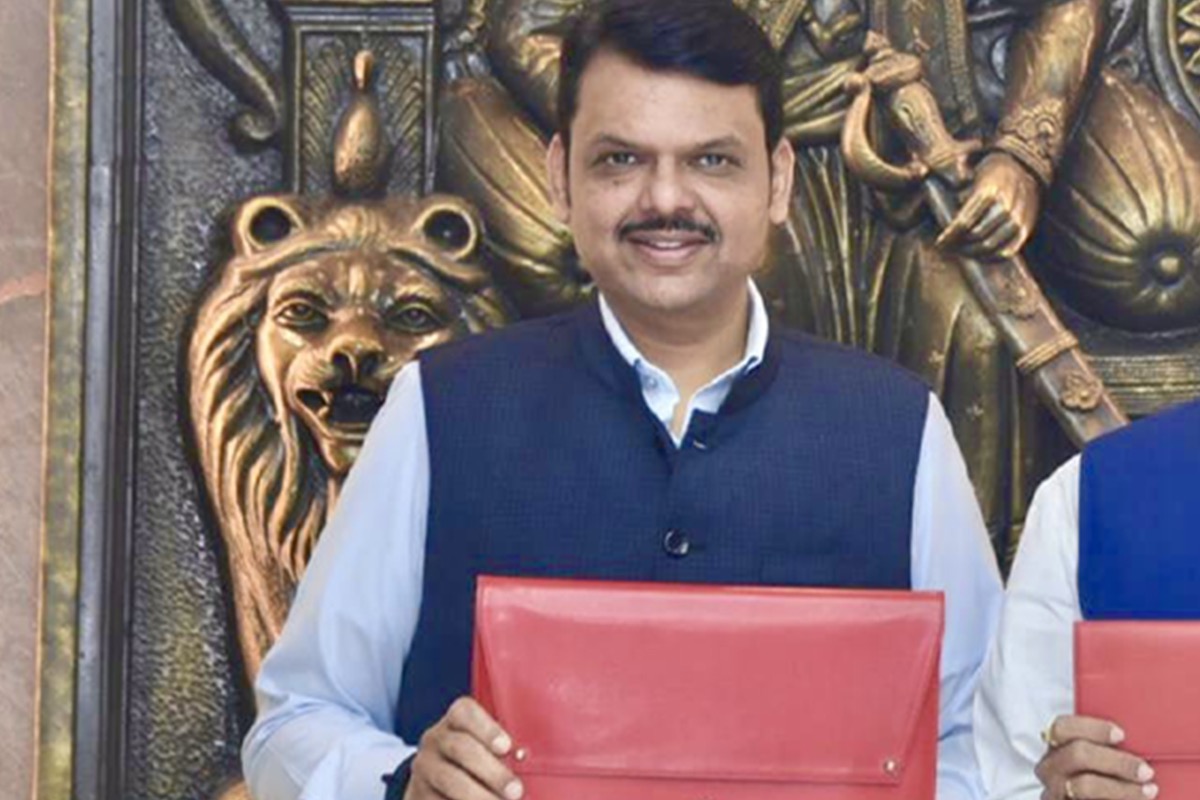

Maharashtra Deputy Chief Minister Devendra Fadnavis on Thursday presented the state budget based on the principle of ‘Panchamrut’ with a focus on farmers, women, youth, employment and environment. This was the Eknath Shinde-led government’s first state budget for the financial year 2023-24.

Fadnavis, who handles the finance portfolio tabled the budget which focuses on farmers, women and the middle class. Fadnavis read out the budgetary provisions from an iPad instead of a traditional paper document.

During the budget presentation, Fadnavis said the outlay for farmers has been increased by Rs 6,900 crore and the coverage of the Mahatma Phule Jan Arogya scheme, a health insurance scheme of the government, has been raised from ₹ 1.5 lakh to ₹ 5 lakh.

Further an amount of ₹ 300 crore to be allocated for development of all five Jyotirlingas in the state. Maharashtra is home to five Jyotirlingas – Bhimashankar, Trimbakeshwar, Grishneshwar, Aundha Nagnath and Vaijanath.

Some major highlights from the budget are –

- Rs 162 crore investments in waterways.

- Rs 29,163 crore proposed for farming.

- Gems and Jewellery Centre at Navi Mumbai.

- Rs 43,000 crore for women and child development proposed.

- Scholarship for students of Classes 5th to 8th raised to Rs 5,000. For students of Classes 8th to 10th will be Rs 7,500.

- Rs 39000 crore for metro projects in Thane, Nashik, Pimpri-Chinchwad

- Rs 12,000 honorarium to Maharashtra farmers per year

- Rs 300 crore to be allocated for development of all five Jyotirlingas in the state.

- 10 lakh affordable houses to be built in next three years

- 50 kilometres of Metro lines to be made operational in the Mumbai Metropolitan Region this year.

- Rs 1,729 crore proposed for beautification of Mumbai.

- Rs 351 crore for Late Bal Thackeray memorial at Shivaji Park, Dadar proposed.

- Water transport from Mumbai to Navi Mumbai, Thane, Vasai-Virar proposed.

- Rs 741 crore proposed for Dr B R Ambedkar memorial at Indu Mills, Dadar.

While presenting the state budget, Fadnavis announced the reduction in the tax on ATF (Aviation Turbine Fuel) from 25 percent to 18 percent in Mumbai, Pune and Raigad. However, the government did not say anything on the issue of Old Pension Scheme, one of the biggest problem for the state government to resolve.