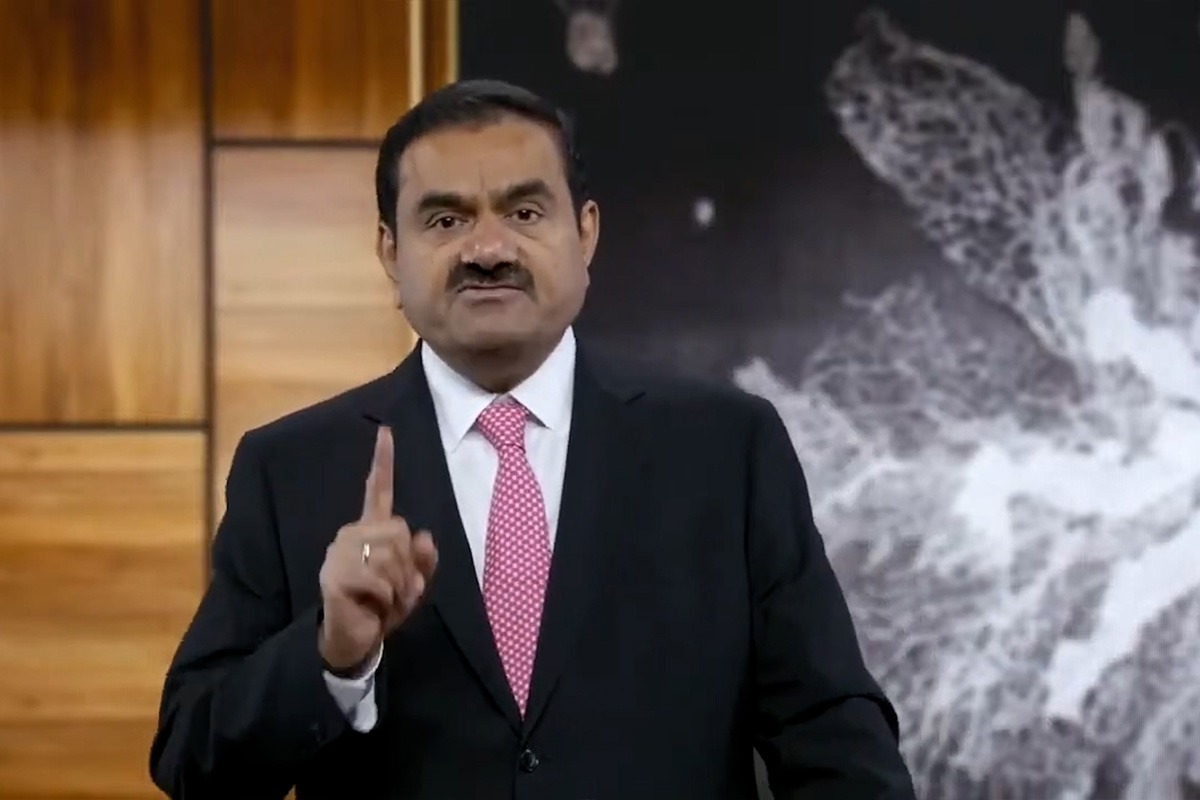

NEW DELHI: Indian billionaire Gautam Adani on Tuesday told investors of his Adani Group that January’s bombshell report by a US-based short-seller, which eroded billions in his wealth, was a combination of “targeted misinformation and discredited allegations”.

Addressing its annual general meeting, the Adani Group chairman said that the majority of allegations of fraud and stock manipulation dated back to 2004-2015 and had been settled by appropriate authorities at that time.

“This report was a deliberate and a malicious attempt aimed at damaging our reputation and generating profits through a short term drive down our stock prices,” said Adani, who currently stands at 24th position in the Forbes list of global billionaires.

ALSO READ: PVR INOX offers ‘Bottomless Popcorn’

He further said: “Subsequently, despite a fully subscribed appeal, we decided to withdraw and returned the money to investors to protect their interest. While we promptly issued a comprehensive rebuttal, various vested interests tried to exploit the claims made by the short seller.”

“These entities encouraged and promoted a false narrative across various news and social media platforms,” adding that a Supreme Court appointed expert committee did not find “any regulatory failure” in its report published in the first week of May.

He continued: “The committee’s report not only observed that the mitigating measures undertaken by your company helped rebuild confidence. But also cited that there were credible charges of targeted destabilization of the Indian markets.”

ALSO READ: Karnataka HC dismisses Twitter plea against Modi govt’s block order

Adani Group of companies came under heavy market pressure after New York-based short-seller Hindenburg Research published a lengthy report in January raising a barrage of questions regarding the operation of Adani companies and his spectacular rise during the Covid pandemic when people were struggling to make ends meet.

In its report, Hindenburg accused the Adani Group of “pulling the largest con in corporate history” by manipulating stock prices and brazen accounting fraud. The energy-to-port conglomerate denied all accusations, calling them a “calculated attack on India”, and later sued the activist firm.

The report, which led to a free fall in the stocks of the Adani Group of companies and wiped out half of its chairman Gautam Adani’s wealth, also gave the opposition a chance to attack the BJP-led central government.

Opposition parties staged protests against the Adani Group across India and stalled parliament proceedings in March demanding a joint parliamentary committee (JPC) probe into alleged irregularities. They accused the Modi government of favouring the Adani Group in lieu of election funding.

YOU MAY ALSO LIKE: