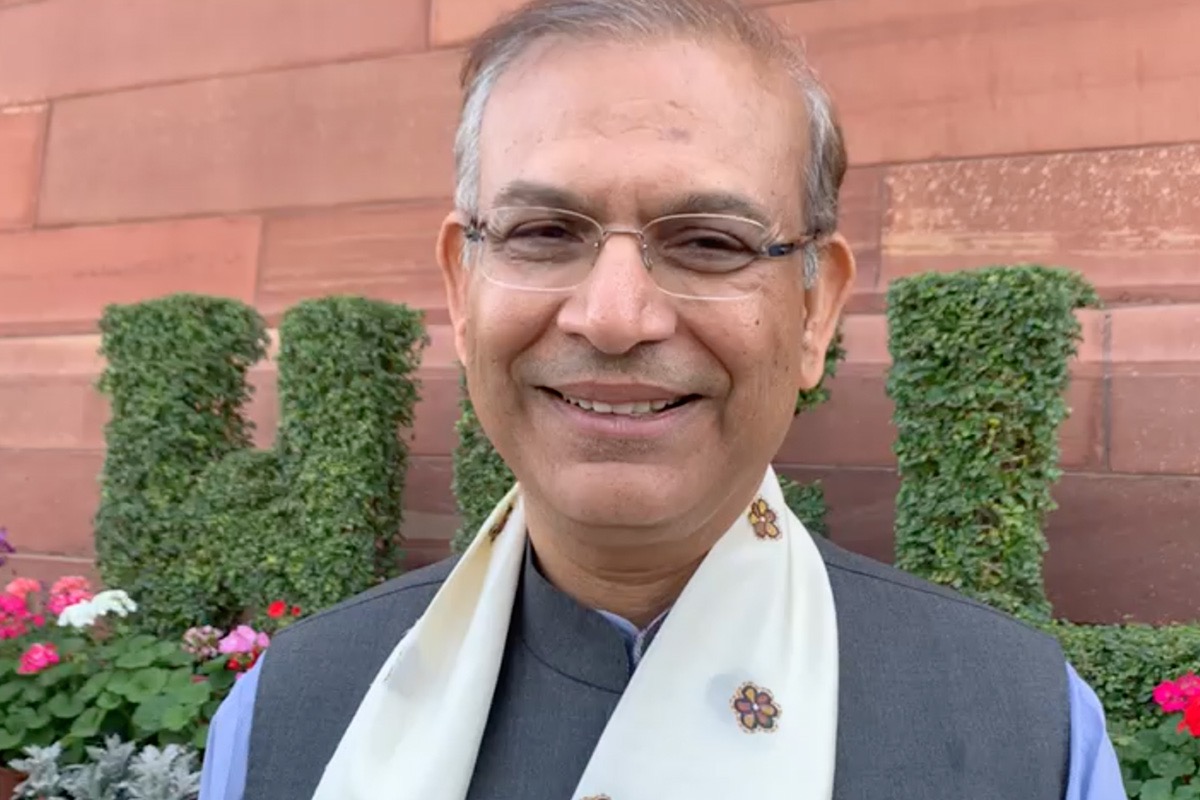

Former Union minister of state for finance Jayant Sinha on Wednesday hailed the Union Budget 2023-24 as “very balanced” and “visionary”, stating that it will help India remain a “shining star” in the global economy.

Speaking to The New Indian at the parliament, Sinha said the Budget has taken care of the interests of every section of Indian society and will boost consumption.

“This is a visionary and a very balanced budget. India is a shining star in the global economy right now. This Budget makes sure that we continue to be a shining star going forward,” the former finance minister said.

Highlighting five major aspects of the Union Budget presented by Union finance minister Nirmala Sitharaman earlier today, Sinha said that the Budget ensures the stability of the micro economy and provides a huge boost to consumption among the middle class through tax rebates.

Sinha, who heads the parliamentary standing committee on finance, said: “There is tremendous support for continued capital expenditure both in public as well as the private sector. There is a tremendous incentive for green growth – green hydrogen, and batteries,” he said.

ALSO READ: Major relief for middle class; no tax for income up to ₹7 lakhs

He also said that provisions made in the Budget will benefit the cooperative sector and boost growth in agriculture and rural sectors.

Reacting to references to India’s richest man Gautam Adani during the Budget speech, the senior BJP leader said that the Opposition is reduced to tired, old clichés. “They have really no substantial criticism.”

In a major relief for the middle class, finance minister Nirmala Sitharaman on Wednesday announced that there will be no tax for salaried persons earning ₹7 lakhs per year under the new personal income tax regime.

Individuals earning more than ₹3 lakhs per annum will require filing their income tax returns but will be eligible for different kinds of rebates.

ALSO READ: Agri fund, millet centre, more credit: What Budget offers to farmers

People with a yearly income of ₹3-6 lakh will need to pay 5 per cent, those earning ₹6-9 lakhs will have to pay 10 per cent of their income, and those getting ₹9-12 lakh per year will have to pay 15 per cent as the personal income tax under the new regime.

As per the new tax slab, a yearly income of ₹12-15 lakh will attract a tax of 20 per cent and those earning more than ₹15 lakhs per annum will have to pay 30 per cent in taxes.

Salaried persons earning up to ₹7 lakhs per annum will be eligible for tax rebates and effectively pay no taxes. “Now I come to what everyone is waiting for, primarily benefit for the hardworking middle class. I propose to increase the rebate for the tax to ₹7 lakhs from ₹5 lakhs,” FM Sitharaman said.