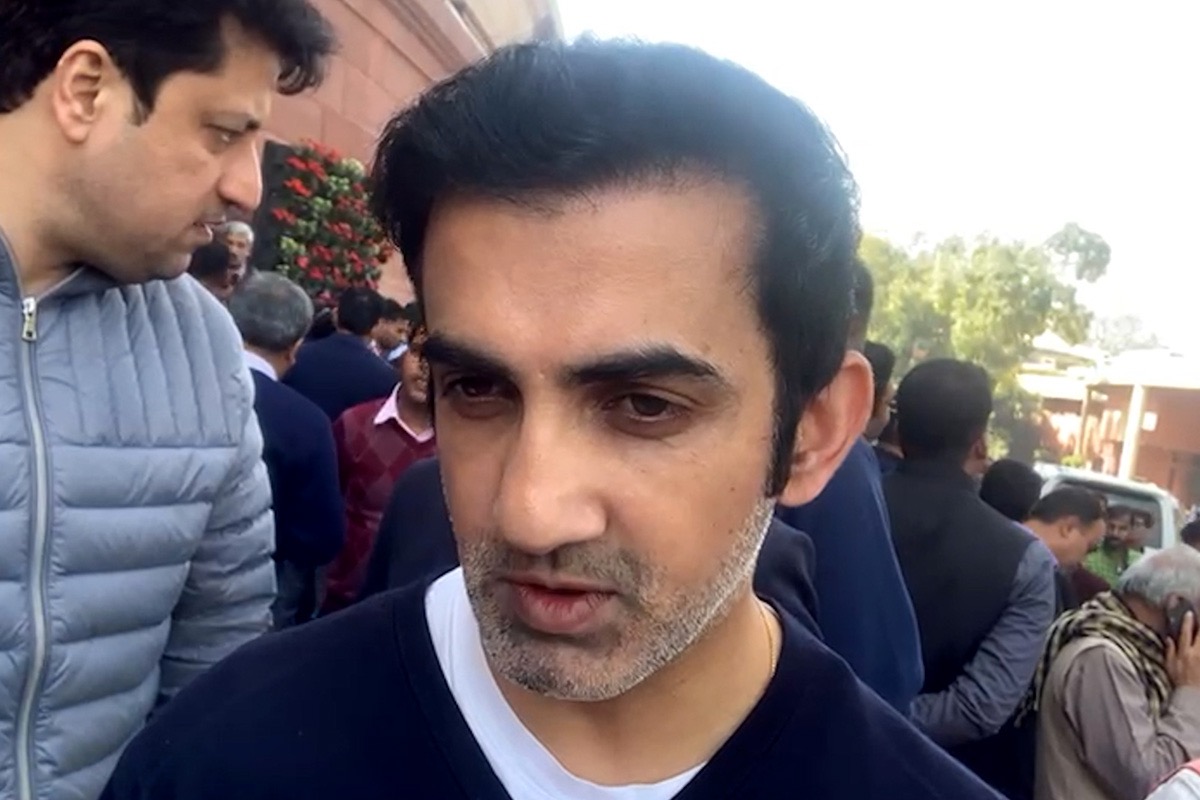

East Delhi BJP MP Gautam Gambhir on Wednesday praised the Central government increasing the tax rebate threshold to ₹7 lakhs per annum, stating that the Budget aims to improve the life of the common man.

Presenting the Union Budget 2023-24 in the Lok Sabha, finance minister Nirmala Sitharaman earlier today announced an increase in the income tax rebate limit from ₹5 lakhs to ₹7 lakhs under the new tax regime.

Speaking to The New Indian at the parliament complex, the BJP leader said, “This is a historic move and will provide great relief to the common man. After what the common man has gone through in the last two years, especially during Covid, this is a historical move and I am sure our country will be cherishing it.”

In her speech, FM Sitharaman said that the government aims to reduce the average processing time for income tax returns from 93 days to 16 days.

“The government intends to roll out next-gen common IT return forms and strengthen grievance redressal mechanisms.”

She further said, “In the new IT proposals, the idea is to maintain continuity and stability of taxation, and further simplify and rationalize provisions to reduce the compliance burden, promote the entrepreneurial spirit and provide tax relief to citizens.

People with a yearly income of ₹3-6 lakhs will need to pay 5 per cent, those earning ₹6-9 lakhs will have to pay 10 per cent of their income, and those getting ₹9-12 lakhs per year will have to pay 15 per cent as the personal income tax under the new regime.

As per the new tax slab, a yearly income of ₹12-15 lakhs will attract a tax of 20 per cent and those earning more than ₹15 lakhs per annum will have to pay 30 per cent in taxes.

In 2020, the NDA government introduced a new personal income tax regime with 6 income slabs, starting from ₹2.5 lakhs. This year, the tax structure has been changed by reducing the number of slabs to 5 and increasing the tax exemption limit to ₹3 lakhs.