New Delhi: In a stark assessment of global affairs, US hedge fund founder Ray Dalio has declared the post-1945 international order “officially broken down”, citing escalating conflicts and economic shifts as evidence of a perilous new era.

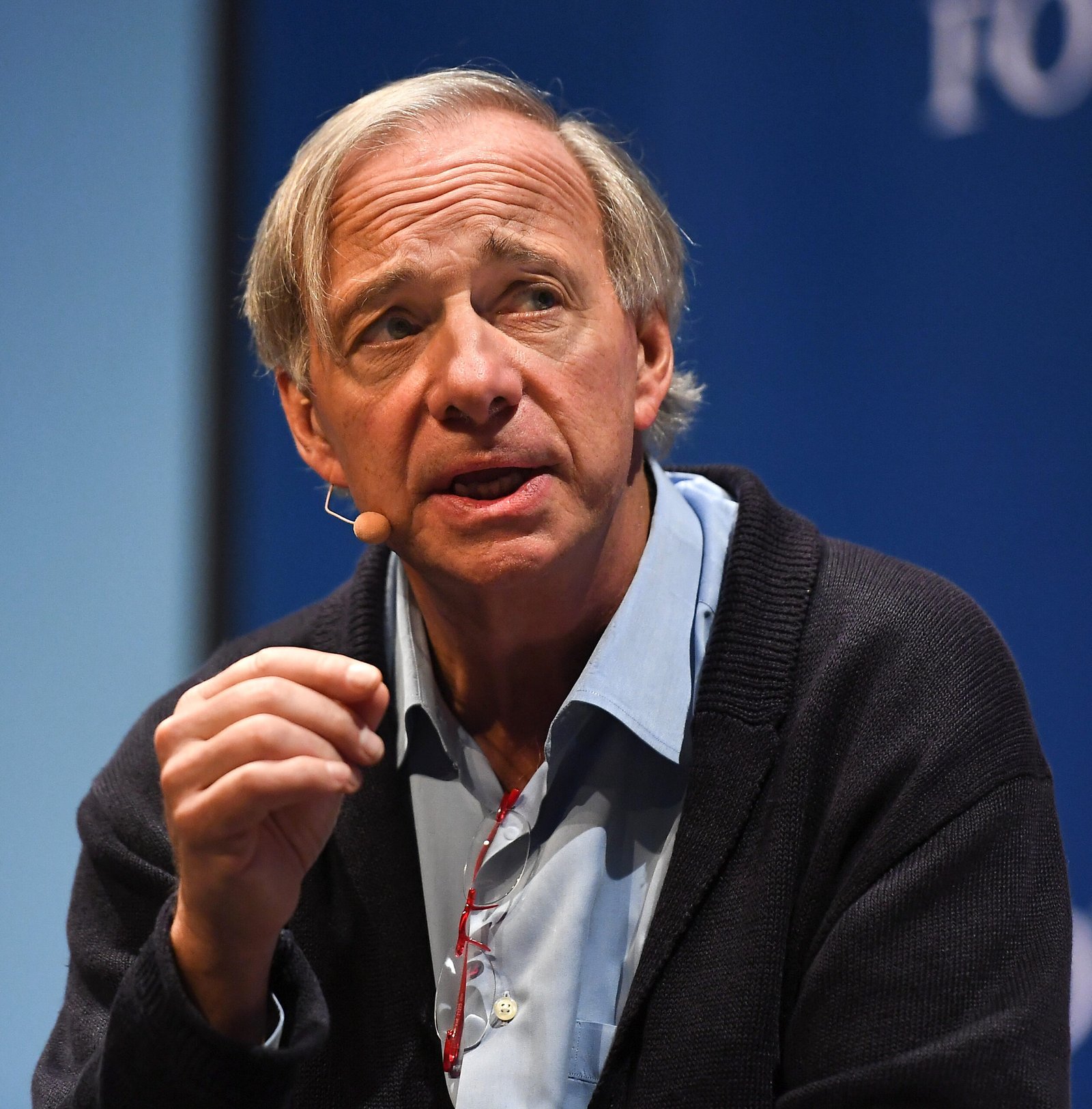

Writing in a lengthy article published on X on 14 February, the Bridgewater Associates chief drew on his “Big Cycle” framework to argue that the world is entering the final, most painful stage of a historical pattern seen over centuries. Dalio, author of the 2021 book Principles for Dealing with the Changing World Order, referenced the recent Munich Security Conference, where leaders pronounced the rules-based system established after World War Two as defunct.

https://x.com/RayDalio/status/2022788750388998543

“The existing fiat monetary order, the domestic political order, and the international geopolitical order are all breaking down,” Dalio wrote, warning of an imminent “brink of wars”. He attributes this to five interlocking forces: mounting debt, widening wealth gaps, rising populism, geopolitical rivalries, and climate change impacts.

Dalio’s analysis traces back 500 years, identifying recurring 50-100 year cycles swinging between prosperous, harmonious periods and “miserable, depressing” phases of conflict and revolution. These “cleansing storms” eliminate excesses like overborrowing but often lead to painful adaptations, including changes in leadership and global power structures.

He places the current moment in Stage 6 of his six-stage model – the breakdown phase – characterised by the collapse of rules-based systems, where “might makes right”. Dalio points to the US as a “tinderbox”, exacerbated by recent events like the Minneapolis shooting and political divisions under President Donald Trump, which he says risk tipping into “more clear civil war”.

Globally, Dalio highlights the erosion of the US-led order, with rising powers like China challenging Western dominance. At the World Economic Forum in Davos last month, he urged leaders to adapt to “modern mercantilism” and a multipolar world, rather than clinging to outdated rules.

For investors, Dalio advises divesting from debt and fiat currencies, favouring gold as wars are typically financed through borrowing and money-printing, leading to devaluation. “Sell out of all debt and buy gold,” he stated bluntly.

The piece, which garnered millions of views and thousands of responses on X, drew mixed reactions. Some praised its historical depth, while critics accused it of Eurocentrism, arguing it overlooks non-Western conflicts like the Taiping Rebellion. Others dismissed it as alarmist, with one user quipping it echoed ancient wisdom: “The strong do what they can and the weak suffer what they must.”

Dalio, a self-described “professional mistake maker”, urged readers to study the cycles to navigate the turmoil. “Do you understand the Big Cycle and do you know how to deal with it?” he asked, offering his insights to help.

As geopolitical tensions simmer – from US domestic unrest to Sino-American rivalries – Dalio’s warning underscores a growing consensus among experts that the old order is irretrievably fractured, demanding new strategies for stability and prosperity.