NEW DELHI: Member of Parliament Rajya Sabha Raghav Chadha strongly criticized the declining efficiency of state-owned banks, warning that eroding trust in the banking system could put millions at risk. He highlighted multiple systemic failures, including poor customer service, excessive hidden fees, rising cyber fraud, and unethical financial product sales.

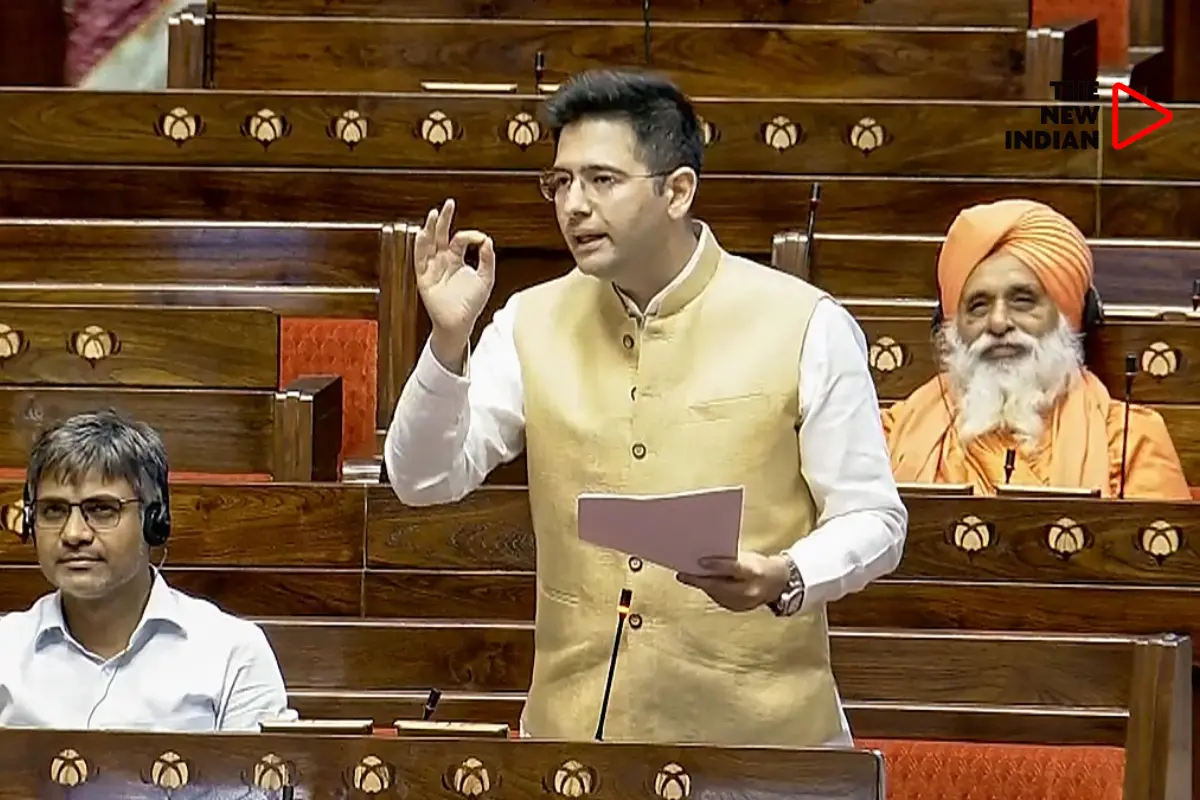

Today, I spoke in Parliament on The Banking Bill, 2024.

I poured my heart out, voicing the everyday frustrations of the common man with our banking system.

1. Poor customer service

2. Limited banking infra in Rural India

3. Cyber fraud and digital data theft

4. Hidden bank… pic.twitter.com/ZfJJJ6HNlb— Raghav Chadha (@raghav_chadha) March 26, 2025

Key Issues Raised:

Subpar Banking Services: Chadha pointed out the inefficiency of government banks, where even basic tasks like passbook updates become a struggle, especially in underdeveloped regions.

Unjustified Charges: He exposed how banks silently extract money from customers through hidden penalties on minimum balances, ATM usage, SMS alerts, and account statements.

Data Privacy Concerns: Raising alarm over unauthorized data sharing, Chadha questioned how telemarketers access customer phone numbers and emails, hinting at possible data breaches by banks.

Cyber Fraud Epidemic: He demanded accountability for the sharp rise in digital fraud, particularly in government-run financial institutions, which report the highest fraud cases.

Outdated Banking Practices: Mocking the sluggish modernization of public sector banks, he remarked, “We buy street food using UPI, yet our banks remain stuck in the 90s.”

Forced Financial Product Sales: Chadha accused banking executives of misleading customers into buying unsuitable insurance and investment products just to meet sales targets.

Chadha urged authorities to revamp banking policies, strengthen consumer protections, and implement stringent cyber security measures. He emphasized that if India is to embrace digital finance, its banking system must evolve to prioritize customer trust, transparency, and security.